By Akers Editorial

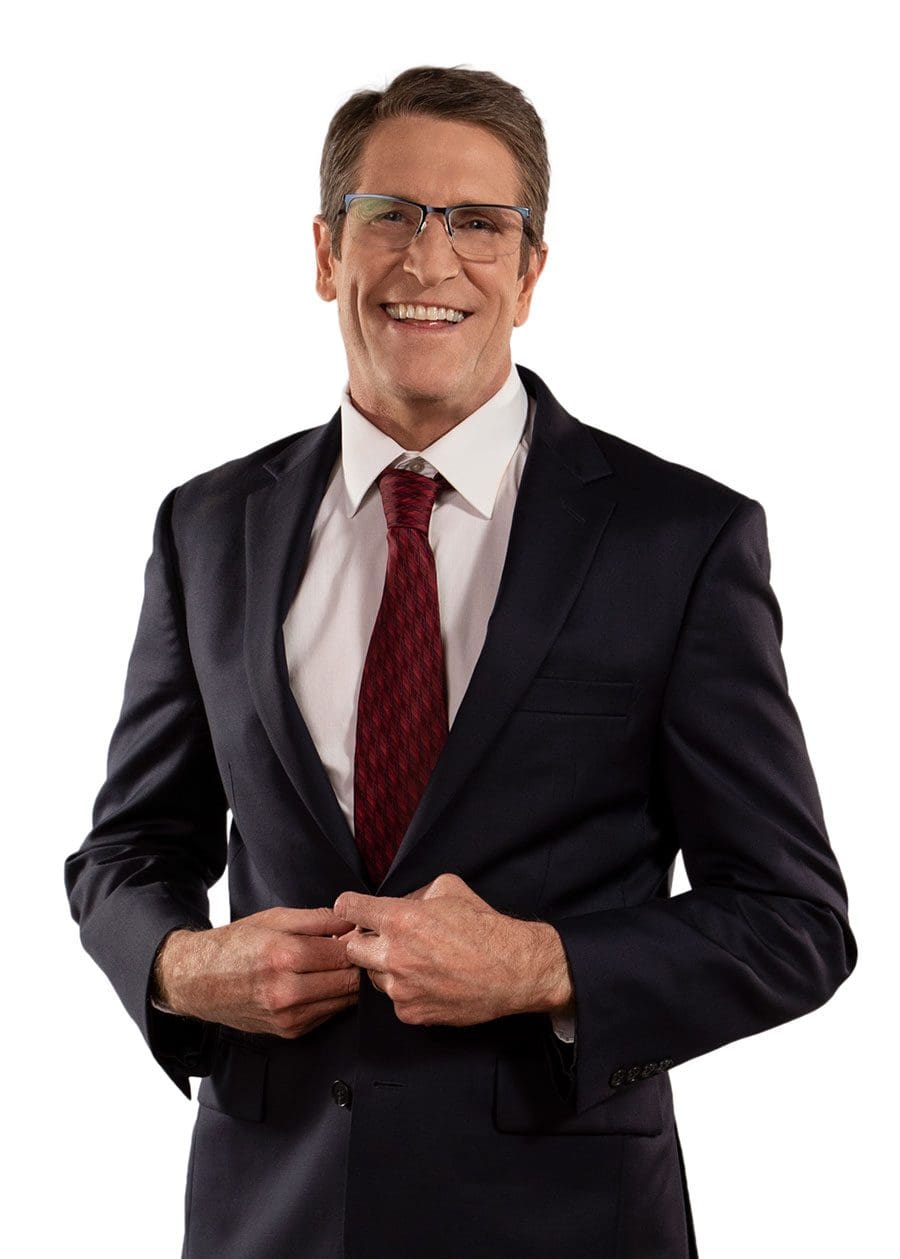

Ask the Expert: Investments | Steve Schneider

Steve Schneider, CEO TB Financial Wealth Management

Q. What are 3 things to do right now during a market downturn?

A. You often don’t hear much about the markets when they’re doing well. Life goes on as normal, and you have a sense of security that your financial future is in good hands. But when the market goes down, people tend to panic. That’s a natural reaction when you see your savings decline right in front of your eyes. You might start having second thoughts about how you could have allocated your money a little differently, but what can you actually do about it now?

First, take a deep breath. You have resources in your corner to help you stabilize your retirement income avenues. No matter how much of your portfolio is tied to the market’s performance, here are three things you should consider doing when the market is declining:

1. SCHEDULE A RISK EXPOSURE REVIEW: How much of your income can be affected by a market downturn? You might think you have a good idea, but do you honestly know? A Risk Exposure Review will tell you the truth and help give you clarity on whether now might be a good time to make some adjustments or to stay the course.

2. REQUEST A RETIREMENT INCOME ANALYSIS: This is nothing more than an analysis of the different sources of income you plan to use in retirement, which might include your 401(k), personal savings, Social Security, or even a pension. With everything laid out on the table, this will help you think through strategic ways to make your money last as long as you live.

3. DEVELOP A HOLISTIC FINANCIAL PLAN: You deserve a great retirement, and we believe a great retirement starts with a plan. However, there’s a big difference between having a financial portfolio and having a financial plan. Sit down with a financial advisor to develop a sound financial strategy that is designed to hold up — regardless of what happens in the markets.

352.350.1161 / tbfinancialgroup.com / 3261 U.S. Highway 441/27, Suite F-2, Fruitland Park

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. TB Wealth Management, LLC is an independent financial investment advisory firm that utilizes a variety of investments. Insurance and annuity products are offered by TB Financial Group, Inc. Investment advisory services offered only by duly registered individuals through AE Wealth Management, LLC (AEWM). AEWM is not affiliated with TB Financial Group, Inc. and TB Wealth Management 1076571 10/21